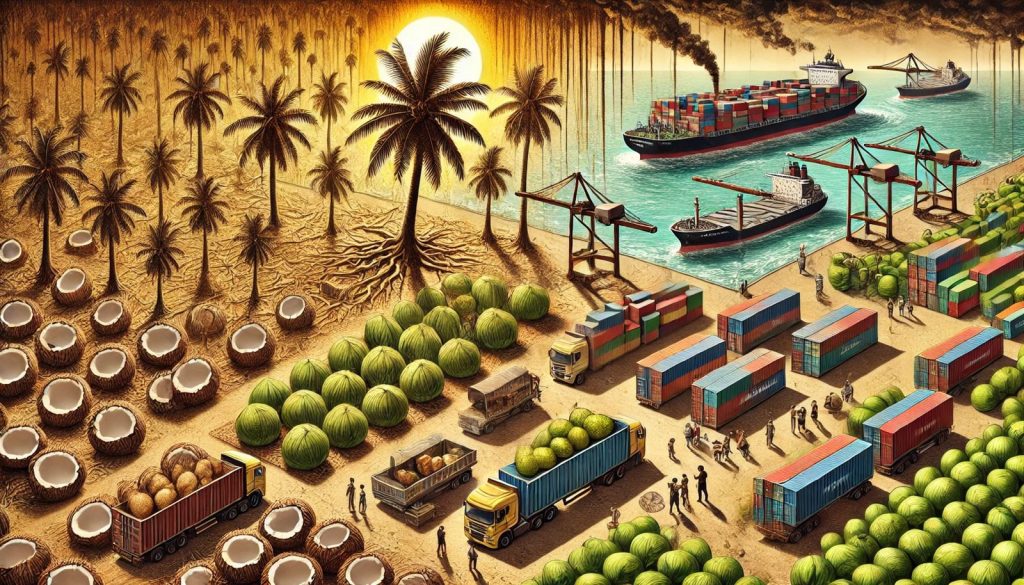

The global coconut industry is currently facing significant challenges stemming from supply shortages, unpredictable raw material availability, and logistical constraints. Major producers like the Philippines, Sri Lanka, Indonesia, and Vietnam are reporting supply disruptions due to unfavorable weather events, such as El Niño and typhoons, compounded by soaring demand in key markets like China, the US, and the EU struggling to replenish dwindling inventories.

Rising Prices and Limited Supply: The prices of coconut milk and cream have risen sharply in countries like Sri Lanka and the Philippines, a trend likely to persist through 2025 due to low inventory levels and restricted availability in primary markets such as Europe and the US. Coconut sap, a raw material for products like coconut sugar, nectar, and aminos, remains scarce due to difficulties in collection under adverse weather conditions. Moreover, risks associated with the sap’s collection and processing, including potential allergens like SO2 and gluten, are ongoing concerns, prompting buyers to test products rigorously before purchasing.

Production Challenges: Two of the leading coconut exporters, the Philippines and Sri Lanka, are grappling with reduced yields caused by smaller harvests resulting from erratic weather patterns. The Philippines anticipates major production declines, with most suppliers already booked for 2024. Similarly, Sri Lanka is seeing reduced harvests coupled with soaring raw material costs and shipment delays. These challenges are expected to persist through spring 2025, potentially tightening supply further and straining factories’ ability to meet year-end and early 2025 demand.

Logistics and Shipping Issues: Despite a slight drop in shipping rates recently, ongoing logistical hurdles, including port congestion and unpredictable shipping schedules, are contributing to higher costs and delays. In Europe, where demand for 2025 coverage is high amidst uncertainty, these challenges are exacerbated by geopolitical tensions, particularly in the Red Sea region. With many vessels rerouting around the Cape of Good Hope to avoid security risks from Houthi rebels, shipping times, fuel consumption, and associated costs have increased. This situation shows no immediate signs of resolution.

Recommendations: Clients are advised to secure coconut supplies promptly and plan for coverage through spring 2025. While the market is expected to stabilize by mid-2025, price pressures may ease after spring, making it prudent to delay entering long-term contracts until then. Maintaining proactive communication with factories and exploring sourcing options is essential during this period.